Discover Close-by Insurance Coverage: Medicare Supplement Plans Near Me

Discover Close-by Insurance Coverage: Medicare Supplement Plans Near Me

Blog Article

Exactly How Medicare Supplement Can Boost Your Insurance Coverage Coverage Today

In today's facility landscape of insurance alternatives, the function of Medicare supplements stands apart as a vital element in enhancing one's insurance coverage. As people navigate the complexities of healthcare strategies and look for comprehensive defense, comprehending the nuances of additional insurance coverage becomes significantly essential. With a focus on linking the voids left by conventional Medicare strategies, these extra options use a tailored approach to meeting details needs. By checking out the advantages, insurance coverage choices, and price considerations connected with Medicare supplements, people can make enlightened decisions that not just bolster their insurance coverage but likewise give a complacency for the future.

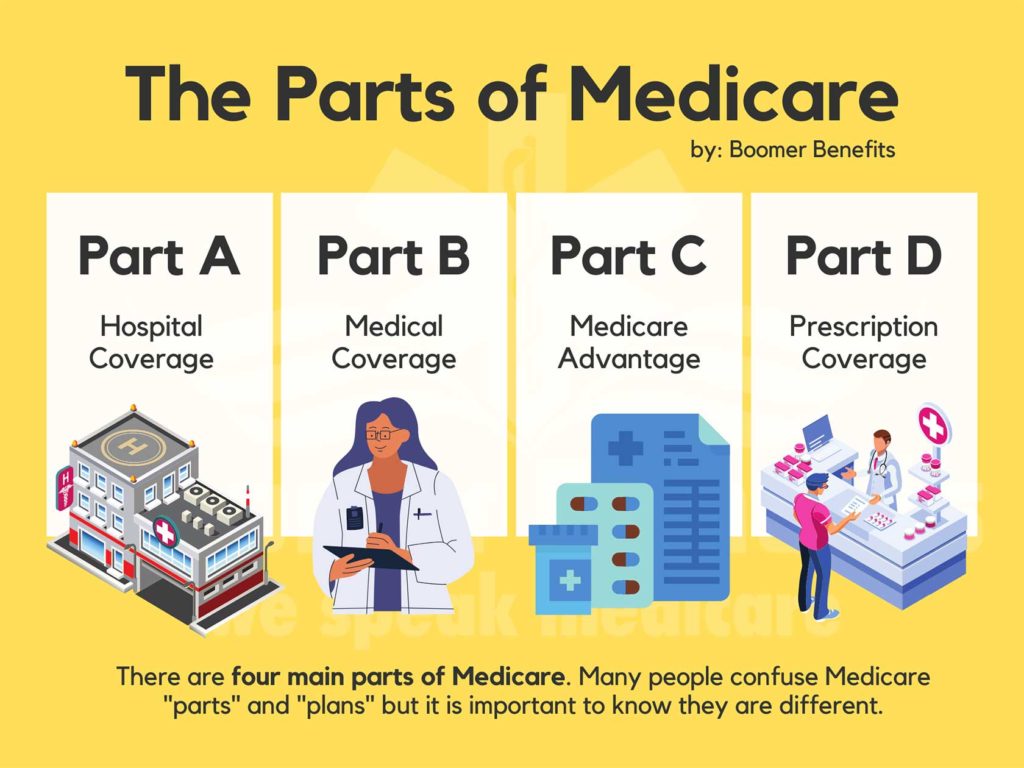

The Essentials of Medicare Supplements

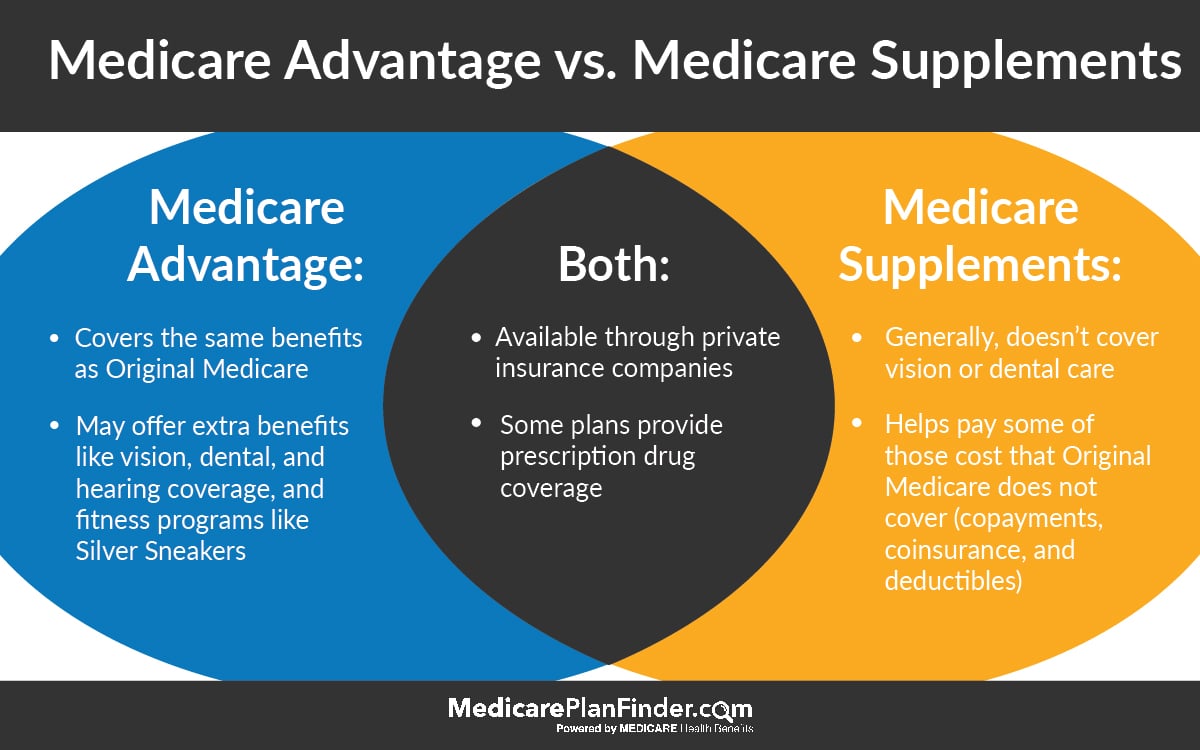

Medicare supplements, likewise called Medigap plans, offer additional coverage to fill the gaps left by original Medicare. These additional strategies are offered by exclusive insurer and are made to cover expenses such as copayments, coinsurance, and deductibles that are not fully covered by Medicare Part A and Component B. It's important to note that Medigap plans can not be made use of as standalone policies yet job together with original Medicare.

One trick element of Medicare supplements is that they are standardized throughout most states, using the same basic advantages despite the insurance policy provider. There are 10 different Medigap plans labeled A via N, each supplying a different level of protection. Plan F is one of the most detailed alternatives, covering almost all out-of-pocket costs, while other strategies might offer more limited protection at a reduced costs.

Understanding the basics of Medicare supplements is vital for individuals approaching Medicare qualification who want to improve their insurance policy coverage and reduce prospective economic concerns related to medical care costs.

Recognizing Protection Options

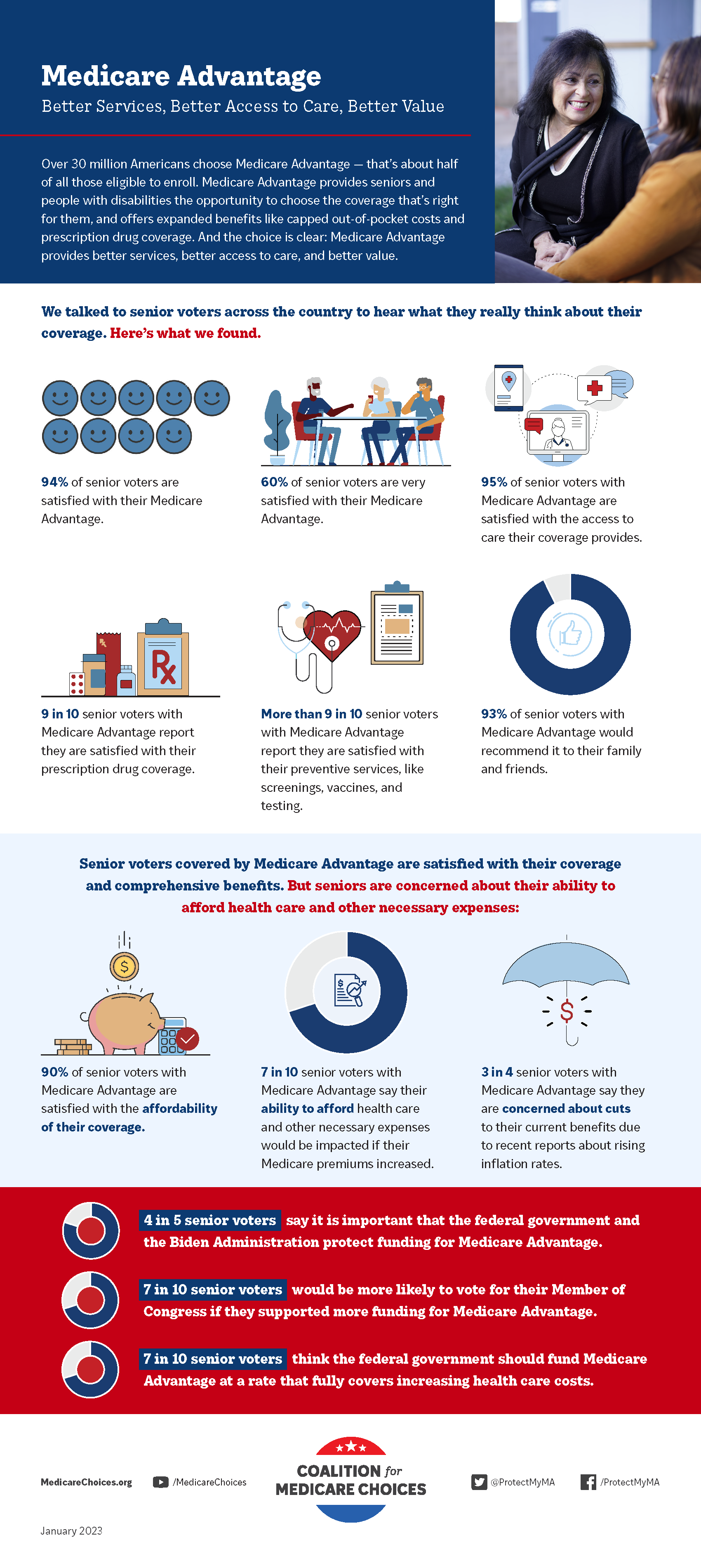

Checking out the varied variety of protection options available can offer valuable understandings right into supplementing medical care expenses efficiently. When considering Medicare Supplement intends, it is vital to understand the different protection choices to make sure thorough insurance protection. Medicare Supplement intends, also recognized as Medigap policies, are standard across most states and labeled with letters from A to N, each offering differing levels of protection. These strategies cover copayments, coinsurance, and deductibles that Original Medicare does not totally pay for, giving beneficiaries with financial safety and security and assurance. In addition, some plans may supply insurance coverage for services not consisted of in Initial Medicare, such as emergency care throughout foreign traveling. Recognizing the coverage alternatives within each strategy type is important for people to select a policy that straightens with their particular medical this link care demands and budget. By carefully assessing the coverage choices readily available, recipients can make enlightened decisions to enhance their insurance policy protection and efficiently take care of health care prices.

Advantages of Supplemental Plans

Comprehending the considerable benefits of supplemental plans can light up the value they give people seeking enhanced health care coverage. One key benefit of supplemental plans is the economic protection they supply by assisting to cover out-of-pocket prices that original Medicare does not totally pay for, such as deductibles, copayments, and coinsurance. This can lead to this content substantial cost savings for insurance policy holders, particularly those who need frequent medical services or treatments. In addition, supplemental strategies supply a broader series of insurance coverage alternatives, consisting of access to medical care providers that might decline Medicare project. This versatility can be crucial for people that have particular medical care needs or like particular medical professionals or experts. An additional benefit of supplemental strategies is the capacity to travel with assurance, as some strategies offer protection for emergency clinical solutions while abroad. Overall, the advantages of supplementary plans add to a more extensive and tailored method to health care coverage, guaranteeing that individuals can obtain the treatment they require without dealing with frustrating monetary concerns.

Price Factors To Consider and Savings

Given the financial safety and security and wider coverage choices given by extra strategies, an important facet to take into consideration is the expense considerations and possible financial savings they offer. While Medicare Supplement plans need a regular monthly premium in addition to the typical Medicare Part B costs, the benefits of minimized out-of-pocket expenses commonly outweigh the included expense. When assessing the price of additional plans, it is vital to compare costs, deductibles, copayments, and coinsurance across different plan kinds to identify the most cost-effective choice based on specific health care demands.

Furthermore, choosing a plan that straightens with one's health and financial demands can lead to substantial cost savings in time. By picking a Medicare Supplement strategy that covers a higher portion of health care expenditures, individuals can minimize unforeseen expenses and spending plan more properly for treatment. Furthermore, some supplemental plans provide household discount rates or rewards for healthy habits, giving further chances for expense financial savings. Discover More Medicare Supplement plans near me. Ultimately, spending in a Medicare Supplement plan can use useful economic protection and assurance for beneficiaries seeking thorough insurance coverage.

Making the Right Selection

With a selection of plans readily available, it is vital to assess aspects such as coverage alternatives, costs, out-of-pocket costs, service provider networks, and general worth. In addition, evaluating your budget constraints and contrasting premium costs amongst various plans can aid make sure that you pick a plan that is budget-friendly in the long term.

Conclusion

Report this page